This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Medicare Advantage - Loss Ratio Analysis 🌠

Compliance Chatter 📢 - NEW Pennsylvania requirements

Sponsor Snapshot 🚀 - brought to you by Modivcare.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Elevance predicts growth as rivals face Medicare Advantage losses - (link)

Medicare Advantage Plans To Be Squeezed Next Year, Reduce Benefits - (link)

CMS recalculates Medicare Advantage star ratings in major win for insurers - (link)

National health spending reached $4.8T last year, CMS actuaries estimate - (link)

National Health Expenditure Projections - (link)

Social Security COLA estimate dips, but seniors remain in a hole. Here’s why. - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Medicare Advantage ~ 2023 Loss Ratio Analysis 🌠

For Medicare focused insurance carriers, one of the most important metrics is the Medical Loss Ratio (“MLR” or “Loss Ratio”).

If the MLR gets too high, the insurance company is likely in financial stress and possibly losing money. If the MLR gets too low, the insurance company may be required to pay a refund. Additionally, a small change in the MLR results in a large change in profit/loss.

Medicare MLRs are analyzed by actuaries, product developers, CFOs, and regulators. They are reported by publicly traded companies each quarter and are submitted to regulatory bodies each year.

The importance of MLRs has been discussed a lot by public and private carriers recently as Medicare utilization has increased, and the level of rate adjustments received by MA carriers was lower in 2024, and is expected to be lower again in 2025.

If you are a leader in the Medicare space, understanding what a loss ratio is, and wrapping your arms around recent market and carrier results will put you one step ahead.

Okay, here we go.

What is a Medical Loss Ratio (MLR)?

In short, the MLR is the percentage ratio of Medical Claims Expense divided by Premium Revenues.

Medical Loss Ratio = Medical Claims Expense / Premium Revenues

Why is it important?

MLRs for Medicare Advantage insurance products are usually between 85 - 90%.

This means there is only 10-15% of the Premium Revenues left to pay other expenses associated with acquiring customers and managing the products.

Once an insurance company pays commissions, administrative and claims expenses, and other overhead expenses, there is typically only 3 - 6% left for profits.

Because of this, a small change in MLR results in a large change in profit.

For Example, if a carrier achieves a 3% profit margin with an 85% MLR, and their MLR drops to 84%, their profit margin increases to 4%. That’s a 33% increase in profit margin based on a 1% drop in MLR!

2023 Loss Ratio Results

With that background in mind let’s take a look at recent full year Medicare Advantage Loss Ratio results.

One note→ The analysis below is based on data reported in the NAIC A&H Experience Exhibits, and excludes data that is reported exclusively to the California Department of Managed Health Care. A rough estimate is that the analysis is missing ~10% of the total MA market.

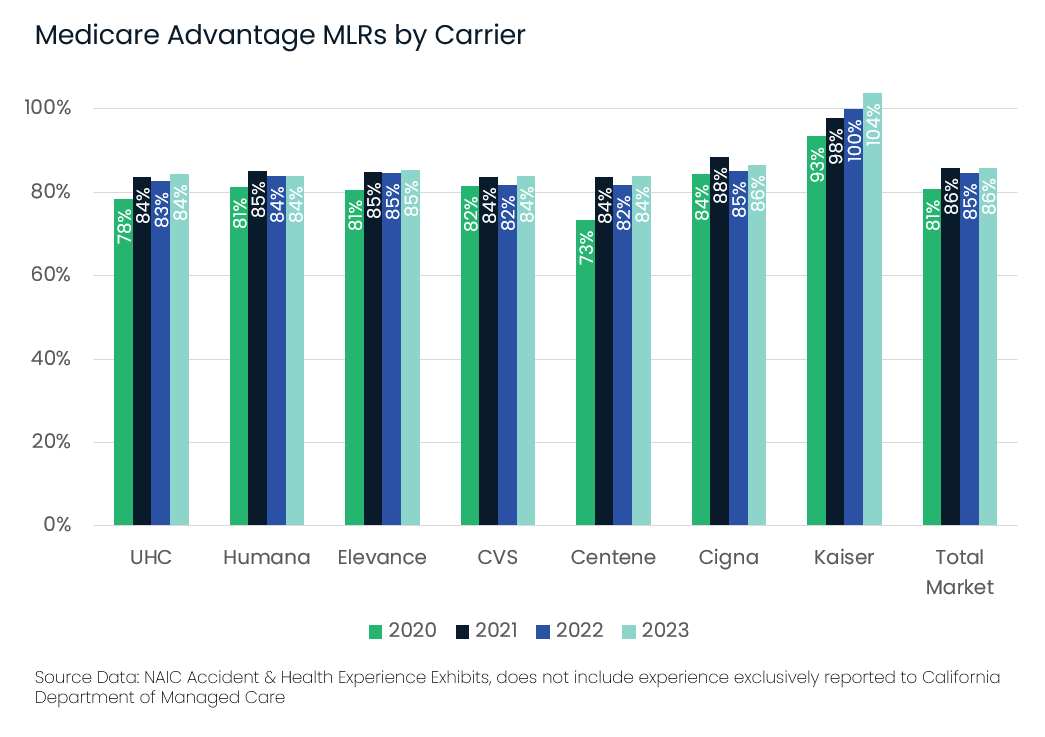

Overall Loss Ratios in the MA market increased to 85.9% in 2023, up from 84.6% in 2022.

Hardly the dire narrative that is out there in the market.

However, early 2024 Loss Ratio results for publicly traded companies were up 2.0% combined in Q1 2024 when compared to Q1 2023 (go here for full break-down). This indicates 2024 MLRs are up meaningfully over 2023.

Results By Carrier

Medicare Advantage MLRs vary by carrier. The chart below displays the top 7 carriers (based on Premium Revenue according to NAIC A&H Experience Exhibits).

The clear outlier in the data is Kaiser. There is analysis here that suggests this is due to the fact that Kaiser is vertically integrated. While the MLR is reported as ~100%, that medical expense is going to provider groups who they own as revenues.

By State for Top 3 Carriers

Medicare Advantage loss ratios also vary by State.

The table below shows 2023 MLRs by State for the 3 largest carriers.

It’s worth mentioning that Humana and CVS have both indicated some pull back in 2025. With the possibility of exiting some counties, and possibly losing membership.

A possible indicator of where some of this may happen is in states with high loss ratios. With that said, given the extreme growth CVS is seeing in 2024, their 2024 loss ratios are likely quite different than it was in 2023.

That’s all for this week!

____

Can you do me a favor? Forward this to another leader in the Medicare space who could benefit from this info. Thanks!

Sponsor Snapshot 🚀: Modivcare

Modivcare’s NEW White Paper explores how collaborations can improve care coordination and bridge significant gaps in the healthcare system.

With the right data, they have seen:

Increased Member Engagement

Reduced Costs

Gaps in Care Closed

Reduced ER Utilization

Download the free White Paper 📄 here → (click)

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

COMPLIANCE CHATTER 📢

Pennsylvania issued a SERFF Bulletin last week, making it the latest state to provide direction on the Tri-Agency Rule notice requirements for fixed indemnity insurance, and notice and duration requirements for and short-term limited duration insurance.

Pennsylvania is requiring that forms used for short-term limited duration and fixed indemnity products after the implementation effective date of the Federal Notice must be updated and submitted for review and approval. The new federal disclosure notice is to be embedded within the forms and be the leading or initial page, with the Company Name and Type of Insurance prominent and clearly identified on the page.

We anticipate more states will provide directives in the coming weeks and will keep you updated.

You can receive weekly regulatory updates like these by subscribing to our Insurance Regulatory Insights newsletter.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: