- Medicare Market Insights

- Posts

- 🏥 Medicare Supplement 101

🏥 Medicare Supplement 101

The Med Supp market grew 36% over the last 10 years. What is it, how is it administered, how is it projected to grow?

This week’s newsletter is Sponsored By: USA Senior Care Network

USA Senior Care Network gives Medicare Supplement carriers the ability to positively impact loss ratios, stabilize rates, lessen the severity of future rate increases, and helps to retain policyholders.

As the Silver Tsunami approaches, Medicare enrollment is going to skyrocket. Are you going to be able to stay competitive in the Medicare Supplement market?

Because all Medicare Supplement carriers provide the same plans and benefits, one of the few ways to differentiate is by providing competitive premium rates. USA Senior Care Network is an exclusive network of hospitals that have agreed to waive all or a portion of the Medicare Part A deductible, currently $1,600.

For an overview of how USA Senior Care Network works, request our two-page handout by emailing [email protected].

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - This week’s deep dive is Medicare Supplement 101

Compliance Chatter 📢 - Telephone Consumer Protection Act 47 U.S.C. § 227.

Sponsor Snapshot 🚀 - brought to you by USA Senior Care Network.

Data Visual of the week 📊 - Data Visual highlighting Med Supp enrollment by plan.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Best Medicare Advantage Insurance Companies for 2024 - (link)

Medicare Advantage marketing practices draw ire from senators - (link)

Physician group slams insurers for overcharging taxpayers for Medicare Advantage - (link)

MA - PDP Plans Offered Lookup Tool - (link)

Medicare Supplement Premium Rates – Looking to the Past and Planning for the Future - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Medicare Supplement 101

If you’ve been following along with the MMI newsletter, you’ve learned that Medicare Parts A and B provide coverage for hospital stays, skilled nursing facility care, hospice care, outpatient, doctor, and preventative services as well as medical supplies.

You’ve also learned that Medicare coverage has gaps and that beneficiaries have out-of-pocket costs to cover including:

🏥 → deductibles, copays, & coinsurance.

Medicare Supplement (“Med Supp”) policies are designed to help with those costs.

Med Supp enrollment grew 36% over the last 10 years and is an important part of the Medicare market.

Let’s take a closer look.

History

The evolution of Medicare Supplement insurance is a relatively recent history. Medicare Supplement coverage began the same year that Medicare was enacted, 1966. In those early years, plan benefits varied greatly between companies and states. As Medicare benefits and rules changed, so did the regulations governing Medicare Supplement insurance.

In 1980, Medicare Supplemental insurance was brought under federal oversight. Through the 90s and early 2000s, additional legislation was enacted to:

standardize plans and benefits

require guaranteed plan renewal (a major protection for beneficiaries!)

prohibit Companies from offering prescription drug coverage to new beneficiaries

Legislation in the last 10-15 years has further refined standardized plan options that companies may offer. In 2010, Plans E, H, I, and J could no longer be marketed to new applicants, but Plans M and N were introduced.

Most recently, the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) was enacted. Under this new regulation Medicare Supplement policies are no longer able to provide coverage for the Part B deductible (Plans C and F) to those newly eligible for Medicare as of January 1, 2020 or later. Why? The overall intent was to help slow Medicare spending. As lawmakers saw it – by requiring a deductible, the beneficiary has a stake in making sure their visit to the doctor justifies the cost.

While Medicare Supplement benefits are regulated at the federal level, individual states are responsible for reviewing rate and commission levels, along with managing eligibility requirements for their market.

Administration

Medicare Supplement insurance is provided by private insurance companies. Companies either use a third-party administrator (TPA) or their own operations units to assist with application processing, underwriting and policy issuance, along with ongoing premium and claims administration.

Medicare Supplement claims are run through the primary payor, Medicare, first. Once a claim is processed through Medicare, it is passed along to the secondary payor: the Medicare Supplement insurance company. Claims are largely processed electronically through auto adjudication by the companies or TPAs who administer the plans.

Eligibility

A beneficiary will have original Medicare, Parts A and/or B, before purchasing a Medicare Supplement policy. Beneficiaries enrolled in a Medicare Advantage plan (Part C) are not eligible for a Medicare Supplement policy. Requirements for enrolling can be confusing when you’re new to Medicare; the chart below provides a simple overview of when a beneficiary may be eligible for a Med Supp policy.

*Some states require companies to offer Medicare Supplement plans to individuals under age 65 that are disabled, have ALS, or have end-stage renal disease.

Medicare beneficiaries have a 6-month “Open Enrollment” period to apply for a Medicare Supplement policy, which starts the first month they have Medicare Part B and they are 65 or older.

During that time, beneficiaries can enroll in a Medicare Supplement policy from any Company – with no health questions or underwriting!

This initial Med Supp “Open Enrollment” period is a one-time enrollment window. It doesn’t repeat every year like the Medicare Advantage Annual Enrollment Period (AEP).

After this initial “Open Enrollment” period, beneficiaries may not be able to buy a Medicare Supplement policy without going through some level of medical underwriting.

In some states, however, Companies may be required to offer special Medicare Supplement enrollment windows annually.

These special windows may be as simple as –

An existing Med Supp policyholder can move to another plan without passing underwriting.

Or as wide-ranging as –

Any Medicare beneficiary can obtain any policy from any Company at any time.

Coverage

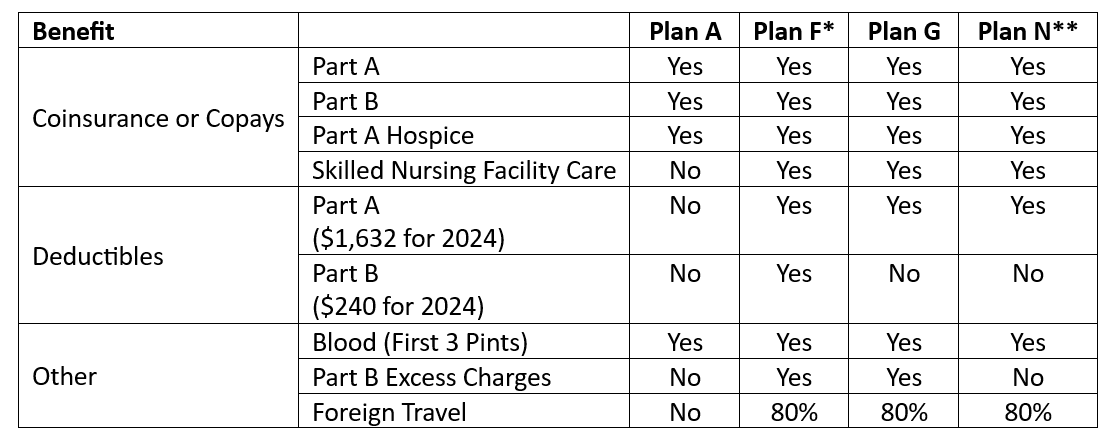

Medicare Supplement plans have standardized benefits and plans are designated by letter-coding.

There are currently 10 standardized plans that Companies may offer:

A, B, C, D, F, G, K, L, M, N

A comparison of benefits for some of the more popular plans is provided below:

*Plans C and F, which provide coverage for the Part B deductible, aren’t available to beneficiaries who were newly eligible for Medicare on or after January 1, 2020.

**Plan N pays 100% of the costs of Part B services, except for copayments for some office visits and some emergency room visits.

Standardized means any plan bought from one company is identical to the same plan bought from any other company. This is also true regardless of where you live and how old you are.

Valerie 👵 – a 65-year-old beneficiary in Idaho – will receive the same benefits for a Medicare Supplement Plan G as Louis 👴 – an 81-year-old beneficiary in Florida.

(Of course, there are always exceptions to the rule – MA, MN, & WI are special and do not offer the 10 standardized plans available in other states.)

Other key coverage highlights for Medicare Supplement plans include:

A Medicare Supplement policy will renew with the same plan benefits if the beneficiary continues to pay their premiums.

Any doctor that accepts Medicare will also accept Medicare Supplement insurance.

In some states, companies may also choose to offer Medicare Select plans or High-Deductible plans.

Medicare Select plans require beneficiaries to use specific hospitals or specific doctors to be eligible for full benefits. They typically have a lower premium than a standard plan.

High-deductible plans start paying for benefits after a beneficiary has met an annual deductible. Plans F and G may be sold with a high-deductible option. These plans also typically have a lower premium than a standard plan.

Statistics

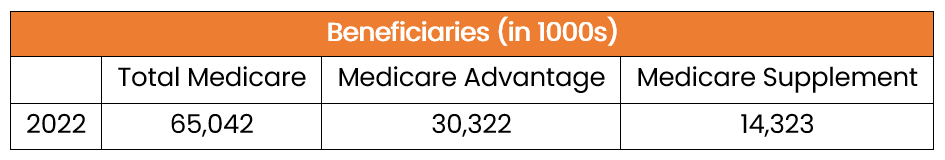

2022 Beneficiary counts for original Medicare, Medicare Advantage plans, and Medicare Supplement insurance are shown below.

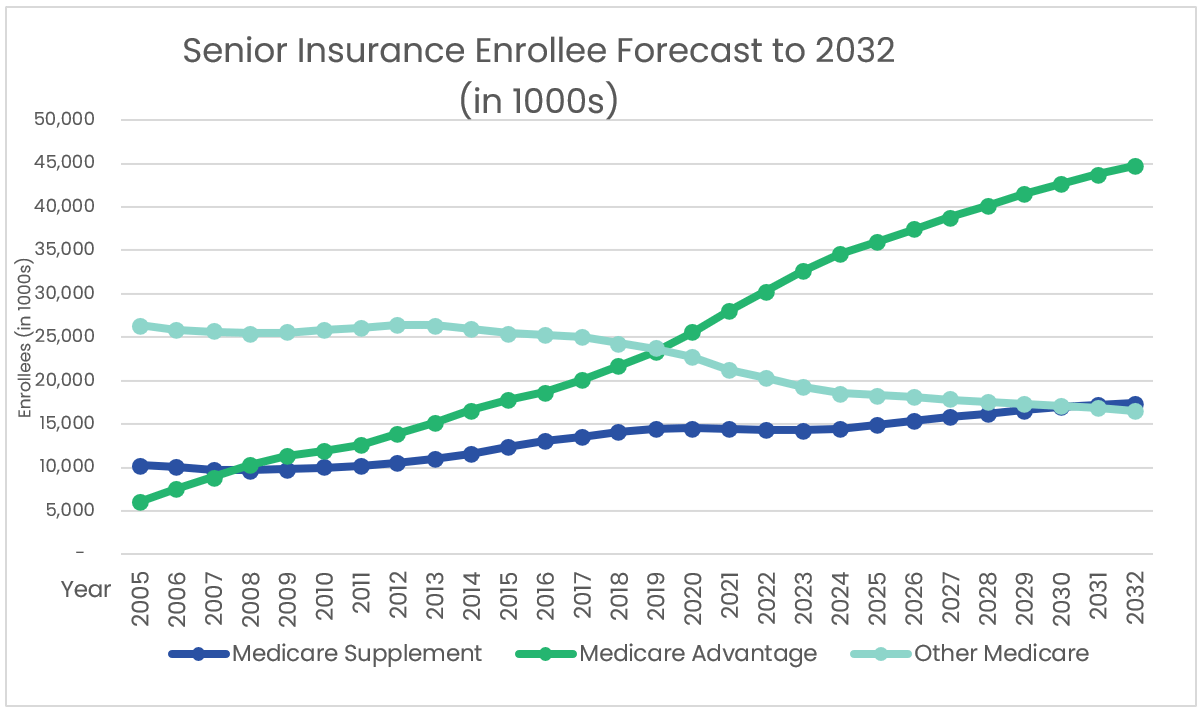

While Telos Actuarial research indicates a slight decrease in Medicare Supplement enrollments in 2023, it is anticipated that enrollments will return to a growth rate that exceeds the Medicare enrollment growth rate, creating robust opportunities for insurance carriers, reinsurers, agents, and marketing organizations in the Medicare Supplement market.

Sources:

2023 Medicare Trustees Report

NAIC Medicare Supplement Experience Exhibits

CMS.gov

Other Public Company Sources

Telos Actuarial Projections

COMPLIANCE CHATTER 📢:

When marketing Medicare products to consumers, it is important to remember that there are laws and regulations outside of what CMS dictates that must be complied with.

Before calling or texting potential Medicare beneficiaries, ensure your business practices are in compliance with the Telephone Consumer Protection Act 47 U.S.C. § 227 to prevent costly litigation and/or fines.

Ways to stay in compliance:

Do not make calls or texts outside of 8:00am-9:00pm local time

Utilize and avoid calling or texting individuals on the National Do Not Call Registry and state Do Not Call lists

Obtain prior express written consent of an individual before using an automated telephone dialing system (dials/texts without human intervention or utilizes artificial or pre-recorded voice) to initiate contact

Send unsolicited fax advertisements only to individuals who you have an established business relationship with

Accept and honor requests from consumers to be removed from your contact list

Both the FCC and state Attorneys General can enforce the TCPA, and consumers are allowed to file a lawsuit to collect damages. Lawsuits can bring reimbursement for actual damages or fines of $500, whichever is greater. If a company knowingly violated the law, that amount can be tripled to $1,500 per violation.

Sponsor Snapshot 🚀: Brought to you by USA Senior Care Network

As the US population ages, more than 80 million people will be Medicare eligible by 2030. The number of people who choose traditional Medicare with a Medicare Supplement is also projected to rise to close to 30% of all Medicare Eligible participants, or approximately 24 million.

CMS regulations related to Medicare Supplement plans mean that all carriers offer the same plans, with no differentiation in plan benefits. One of the few ways for a carrier to stand out, is through premium pricing. With premiums being determined primarily by plan costs, controlling Medicare Supplement expenditures is the most effective way to offer competitive rates. The challenge is the limitations on what carriers can do to control these expenditures.

Participating in USA Senior Care Network (USA SCN) offers carriers a powerful way to reduce plan costs with no impact on policyholders’ benefits. USA SCN’s network of hospitals have agreed to waive all or a part of the Part A Deductible for inpatient care. Carriers who participate in the program have seen lower premium increases vs carriers who are not participating.

Here are some current details of USA Senior Care Network:

Over 140 Medicare Supplement carriers are USA SCN clients and realize program savings which allow them to stay competitive.

11 million policyholders currently participate in the program.

This represents more than 75% of all Medicare Supplement Policyholders nationwide.

USA SCN carrier clients have saved more than $800 million by utilizing the program.

Medicare Supplement policyholders that participate in USA SCN are channeled to participating hospitals through a combination of an online hospital directory, US-based Customer Care call center, and carrier communications. With USA Senior Care Network, carriers benefit by reducing costs, hospitals gain new patients and policyholders see lower premium increases.

For an overview of how USA Senior Care Network works, request our two-page handout by emailing [email protected].

DATA VISUAL of the Week 📊

This week’s data visual comes from Telos Actuarial. It shows how the distribution of policies by plan in Medicare Supplement has changed over time.

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: promote your product or services to leaders in the Medicare space. Let’s discuss. (link)

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market, appraise your books of business, and keep you compliant. Let’s discuss. (link)