This week’s newsletter is Sponsored By: Medicare Market Insights - Plus

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Stars, Premium, Deductibles & MOOPs - MA Landscape 🏞 (Part 2)

Sponsor Snapshot 🚀 - brought to you by Medicare Market Insights - Plus

Compliance Chatter 📢 - final guidance from CMS regarding drugs, disaster impact on NC Medicare, also new info on WI and OR!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

2025 Medicare Advantage and Part D Star Ratings - (link)

Social Security Administration announces 2.5% cost-of-living adjustment for 2025 - (link)

Hospitals sick of fighting for Medicare Advantage dollars - (link)

Huntsville Hospital terminates participation agreement with insurance giant - (link)

Summary of 2025 Star Rating Cut Point Changes - Wakely - (link)

Change in Alzheimer’s Drug Vial Size Could Be Big Money-Saver for Medicare - (link)

Medigap Issuers Face Spike in Small Problems That Got Serious - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

The 2025 Annual Enrollment Period (“AEP”) is underway.

Yesterday was the first day. And for at least part of the day yesterday the Medicare.gov Plan Finder looked like this:

😨

In some ways this is a fitting way to start. We’ve been warning you that this AEP is going to be wild.

In all seriousness, I hope this didn’t impact any seniors ability to access new plans, and I’m glad things seem to be up and running now!

In today’s deep dive we are going to look a bit closer at 4 data points that we pieced together using CMS enrollment data, Crosswalk files and Landscape files.

Star Rating comparisons between 2024 and 2025 for plans that are renewing in 2025

Monthly Premium comparisons between 2024 and 2025 for plans that are renewing in 2025

Drug Deductible comparisons between 2024 and 2025 for plans that are renewing in 2025

OOP Max comparisons between 2024 and 2025 for plans that are renewing in 2025

[Note: MMI+ subscribers will be able to download the full dataset tomorrow]

Last week MMI+ subscribers got a deep dive analyzing terminating plans. 7% of the individual MA/MAPD enrollees have plans that are terminating Jan. 1 (up from ~1% in previous years).

But, that also means that 93% of enrollees have plans that will be renewing.

This week’s deep dive is focused on these plans/enrollees. Will they be seeing changes to star ratings, monthly premiums, drug deductible and out-of-pockets maximums?

[Note: we are only looking at Individual HMO/POS, PPO, and PFFS plans.]

Star Ratings

2025 Star Ratings were released last week.

The overall enrollment weighted star rating decreased from 4.07 in 2024 to 3.92 in 2025.

This is the lowest overall star rating in recent history, and will result in continued pressure on Medicare Advantage profitability over the coming years as star ratings are a key driver of bonus revenues.

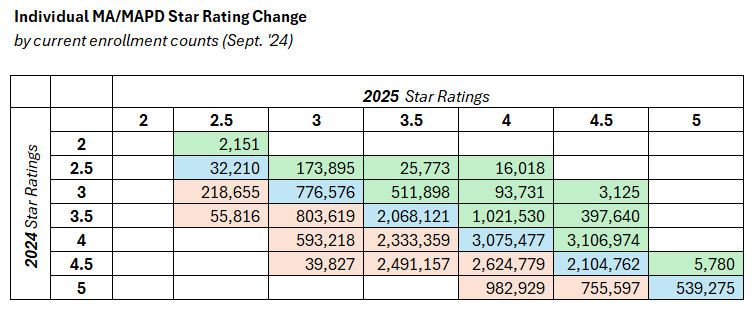

The table below looks at Star Rating changes from 2024 to 2025 (for the plans that are renewing in 2025), and includes the current enrollment in each bucket.

44% of current enrollees are in plans that will see a star rating decrease (everything in red above)

35% of current enrollees are in plans that will see no change in star ratings (everything in blue above)

22% of current enrollees are in plans that will see a star rating increase (everything in green above)

Given the pressure on MA/MAPD plans, you might expect that premiums will be going up in 2025. But are they?

Not really.

The overall enrollment weighted average monthly premium is going from $18.07 in 2024 to $17.47 in 2025 (down 3.3%).

Currently, 60% of the individual MA/MAPD market had a $0 premium plan.

If everyone sticks with their same plans in 2025, 61% of the market will have $0 plans.

Finally, the majority of the current market will see premiums that either stay the same or decrease (82%).

18% of the market will see an increase in premiums, with the enrollment weighted average change of $11 per month.

Premium Bucket | Current Enrollment | % | Average $ Change |

|---|---|---|---|

Premiums Increasing in 2025 | 4,514,304 | 18% | $10.96 |

Staying the Same | 15,745,751 | 61% | $0 |

Premiums Decreasing in 2025 | 5,372,442 | 21% | $(12.06) |

Drug Deductible

Again, MA/MAPD plans are under pressure with the Inflation Reduction Act specifically shifting more of the Rx burden to Plans (though the “premium stabilization” program dampens that impact) with the introduction of a $2,000 max out of pocket in 2025 (down from $3,300 in 2024).

So, if Monthly Premiums are not increasing, are the Drug Deductibles increasing for MAPD plans?

Yep.

The overall enrollment weighted average Drug Deductibles is going from $176 in 2024 to $309 in 2025 (up 76%).

Currently, 60% of the individual MAPD market has a $0 Drug Deductible.

If everyone sticks with their plans in 2025 only 31% of the market will have a $0 Drug Deductible.

You can see a large decrease in the share of enrollees with $0 Drug Deductibles, with a large increase in enrollees with Drug Deductibles in the $200+ range.

The majority of the current market will see drug deductibles increase (63%).

Only 4% of the market will see an decrease in their drug deductible.

Drug Deductible Bucket | Current Enrollment | % | Average $ Change |

|---|---|---|---|

Drug Deductible Increasing in 2025 | 15,799,493 | 63% | $222 |

Staying the Same | 8,229,000 | 33% | $0 |

Drug Deductible Decreasing in 2025 | 920,629 | 4% | $(174) |

In Network Max Out-Of-Pocket (“MOOP”)

Premiums are generally not increasing, drug deductibles are increasing, what about the In Network Max out-of-pocket (“MOOP”) amounts?

Note: due to a change in the landscape file data, we can only compare the MOOP for Non SNP plans

Yes and No.

The overall enrollment weighted average MOOP is going from $4,644 in 2024 to $4,973 in 2025 (up 7%).

But, the details are a bit more important on this one.

55% of current enrollees will see either no change or a decrease in MOOP.

But, the weighted MOOP change for the 45% that is increasing is $871.

MOOP Bucket | Current Enrollment | % | Average Change |

|---|---|---|---|

MOOP Increasing in 2025 | 8,588,242 | 45% | $871 |

Staying the Same | 7,695,979 | 41% | $0 |

MOOP Decreasing in 2025 | 2,641,526 | 14% | $(441) |

Bottom Line

So, what did we learn about Individual MA/MAPD plans as we go from 2024 to 2025?

Star Rating Down

Premiums Level/Down

Drug Deductibles Up

MOOP Mixed, though largely up

This is only scratching the surface on plan changes in 2025. A more detailed view of plan benefits will reveal changes to formularies, along with large changes to supplemental benefits.

That’s all for now. It’s time for me to head to a 9th grade volleyball match (go Mustangs)!

Happy AEP!

What MMI + Subscribers read this week…

MA Plan Termination 2025 - A deep dive into the 2025 MA Plan Terminations by Plan Type, Carrier & State. [includes downloadable data set!] (link)

New MA Downloadable Data Set (sent tomorrow) - Analyze change in Stars, Premiums, Drug Deductibles, MOOPs across State, County, Parent Org., Plan Type and more.

Sponsor Snapshot 🚀: Medicare Market Insights - Plus

The Medicare market is filled with data, but pulling it all together, interpreting it, and making it actionable takes time—time that busy leaders don’t have.

The Solution: Medicare Market Insights - Plus offers you the advantage you need:

Exclusive Medicare Advantage Insights Web Application: Instantly access critical data and trends with our easy-to-use tool. Drill down into enrollment by state, payer, county, and plan type, and uncover opportunities that others miss.

Members-Only Deep Dives: Stay ahead with in-depth analyses of market shifts and strategic opportunities. Our content is designed to help you find the next big win.

Expertly Curated: Our data is combined with analysis from experienced actuaries and presented in a way that’s easy to digest, even for the busiest executives.

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter, which includes final guidance from CMS for the second cycle of Medicare Drug Negotiations, a Disaster Declaration from North Carolina (including impact to Medicare Supp), a new address for the Wisconsin Commissioner of Insurance, and Short-Term Care guidance from Oregon.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: