- Medicare Market Insights

- Posts

- Part D: The Medicare Alphabet Caboose 🚃

Part D: The Medicare Alphabet Caboose 🚃

Medicare Part D 101 Deep Dive

This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Part D: The Medicare Alphabet Caboose 🚃

Compliance Chatter 📢 - Special Supplemental Benefits for the Chronically Ill (SSBCI) proposed rule.

Sponsor Snapshot 🚀 - brought to you by Modivcare.

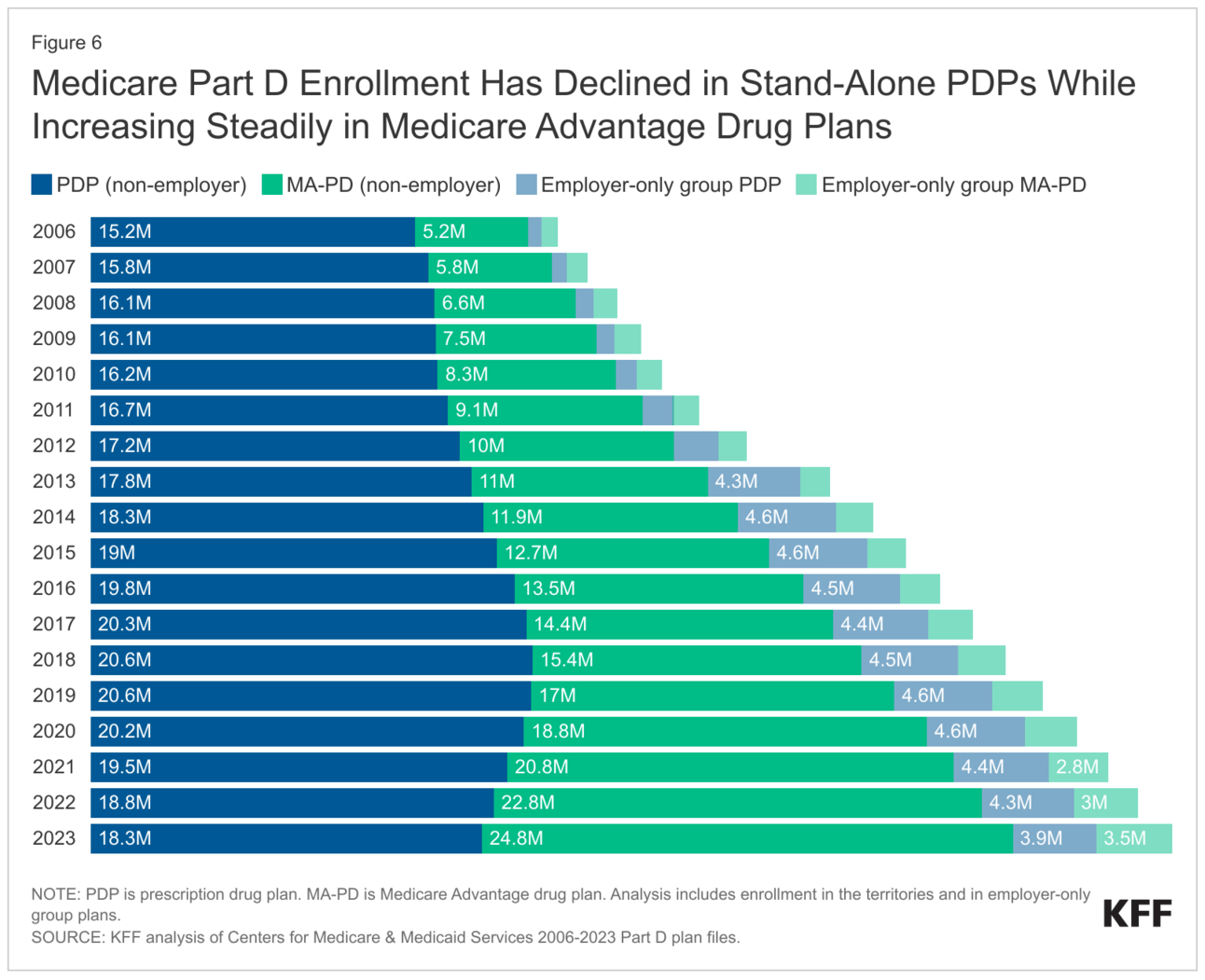

Data Visual of the week 📊 - Data Visual highlighting enrollment in Part D coverage on a stand-alone basis vs. with Medicare Advantage.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Centene echoes Humana’s concerns about proposed MA rate drop - (link)

Projected Savings Medicare Beneficiaries Need for Health Expenses Increased Again in 2023 — Some Couples Could Need as Much as $413,000 in Savings - (link)

Humana reaffirms 2025 guidance as CMS pitches decrease in MA benchmark payments - (link)

Despite sale of its MA business, Cigna CEO says the market is still 'attractive' - (link)

Hospital lobbying could sink effort to trim Medicare costs - (link)

2025 Medicare Advantage and Part D Advance Notice Fact Sheet - (link)

Medicare Regulatory Compliance Updates- (link)

Jared’s recent LinkedIn posts:

SNP enrollment grew ~246 k from Dec. '23 to Jan. '24 - (link)

$3.3 billion. That's the price HCSC is paying for Cigna's Medicare block. - (link)

How is OEP going for everyone? - (link)

Cigna (CI) - reported Q4 2023 results last week.- (link)

Centene Corp (CNC) - reported Q4 2023 results yesterday - (link)

DEEP DIVE 📚

Part D: The Medicare Alphabet Caboose

As you get older, the need for prescription drugs to counter health ailments increases. Medicare Parts A and B only cover limited prescription drugs, including certain vaccines, some cancer medications, and medications given while being treated as inpatient or at a health facility.

Medicare Part D is sold by private insurance carriers and offers Medicare beneficiaries outpatient prescription drug coverage that is otherwise not included in original Medicare.

Note: Medicare Advantage (Part C) plans typically include Part D benefits as part of the benefit package (referred to as “MAPD”).

Coverage

Each Part D plan provides a formulary, or comprehensive list of covered prescription drugs.

If a drug is not included in this formulary, the Part D beneficiary must pay full cost for that drug.

All Medicare drug plans must include coverage for at least 2 prescription drugs in each of the most commonly prescribed drug categories and classes.

For certain “protected” classes (listed below), each Part D plan must include all, or substantially all drugs within the class:

Anticonvulsants

Antidepressants

Antineoplastics

Antipsychotics

Antiretrovirals

Immunosuppressants

Plan formularies include both brand-name and generic prescription drugs.

In addition, prescription drugs are categorized into tiers. Prescription drugs in lower tiers will generally cost less than those in higher tiers.

Some drugs may have quantity limits or require prior authorization.

Additionally, some prescription drugs require a “stepped” approach, where prior to approval, the beneficiary is required to try certain lower cost drugs for specified time periods where the intended results are not achieved.

Costs

Each Part D plan requires beneficiaries to pay a monthly premium to receive prescription drug coverage.

The average monthly premium for an individual Part D plan is $59.22 in 2024, which is a 20% increase from 2023. This increase is likely due to rising drug costs, changes to deductibles and copays, and Part D program changes resulting from the Inflation Reduction Act (keep reading to learn more).

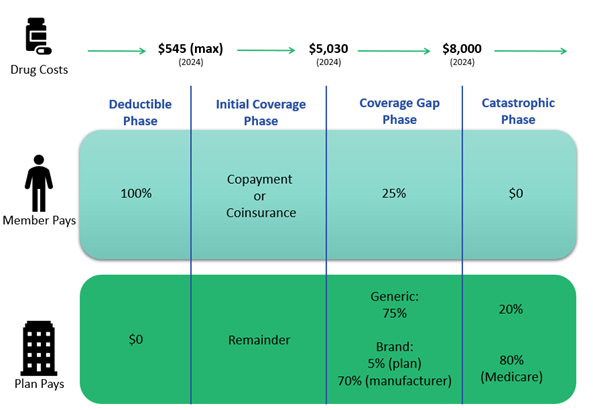

In addition to a monthly premium, Part D beneficiaries pay different amounts for their covered drugs depending on the phase they are in:

1. Deductible Phase: Until the Part D deductible is met, a beneficiary will pay the full price of their covered prescription drugs.

In 2024, CMS has limited the Part D deductible to $545 or less for all plans.

A Part D plan may also choose to not require a deductible or limit the deductible to certain tiers of drugs. Compared to the past 3 years where 70% of plans charged the maximum deductible, 58% of plans in 2024 have a Part D deductible of $500 or more.

Deductible Amount | % Plans |

$0 Deductible | 14% |

$100-$199 Deductible | 5% |

$200-$299 Deductible | 11% |

$300-$399 Deductible | 5% |

$400-$500 Deductible | 6% |

$500+ Deductible | 58% |

2. Initial Coverage Phase: Once the deductible has been reached, a beneficiary will be responsible for a copayment or coinsurance, with the Part D plan covering the remaining covered drug cost.

3. Coverage Gap Phase (a.k.a. “Donut Hole”): Once the total amount spent on covered prescription drugs reaches the initial coverage limit ($5,030 in 2024), the beneficiary will be responsible for 25% of the cost of their covered prescription drugs. The deductible and any amount paid by the beneficiary and plan for covered drugs, except monthly premiums, are factored into the total amount spent to reach the initial coverage limit. Some Part D plans offer additional coverage during this phase.

4. Catastrophic Coverage Phase: Once the beneficiary’s out-of-pocket costs for covered prescription drugs has reached the catastrophic coverage limit ($8,000 in 2024), the plan and Medicare will cover the beneficiary’s drug costs for the remainder of the year. The Catastrophic Coverage Phase has been recently impacted by legislation, which you can learn more about in a recent Compliance Chatter.

A late enrollment penalty may be assessed if a Medicare beneficiary experiences 63 or more days in a row without prescription drug coverage through Medicare or another creditable plan after their Initial Enrollment Period. The late enrollment penalty is applicable, and must be paid, for as long as a beneficiary’s Medicare drug coverage is active.

Part D beneficiaries with a monthly income of up to $1,843 in 2024 ($2,485 for couples) may be eligible for low-income subsidy, which helps pay Part D monthly premiums, lowers costs of prescription drugs, and eliminates any late enrollment penalty.

Enrollment Trends

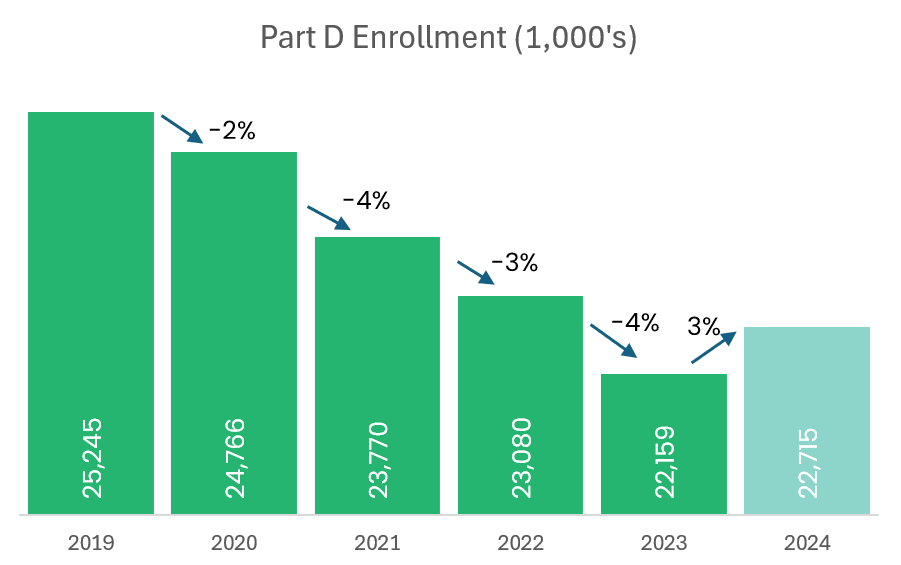

There are 817 (716 individual and 101 employer-sponsored) Stand-alone Part D plans offered by 48 different carriers that provide coverage for more than 22.7 million people in 2024.

From 2019 to 2023 there was a steady 3.2% average annual decrease in Part D enrollment. Early Part D enrollment counts in 2024 indicate a 3% increase in enrollment from 2023, attributed to the increasing enrollment in employer-sponsored Part D plans.

*Excludes plans with less than 10 enrollees.

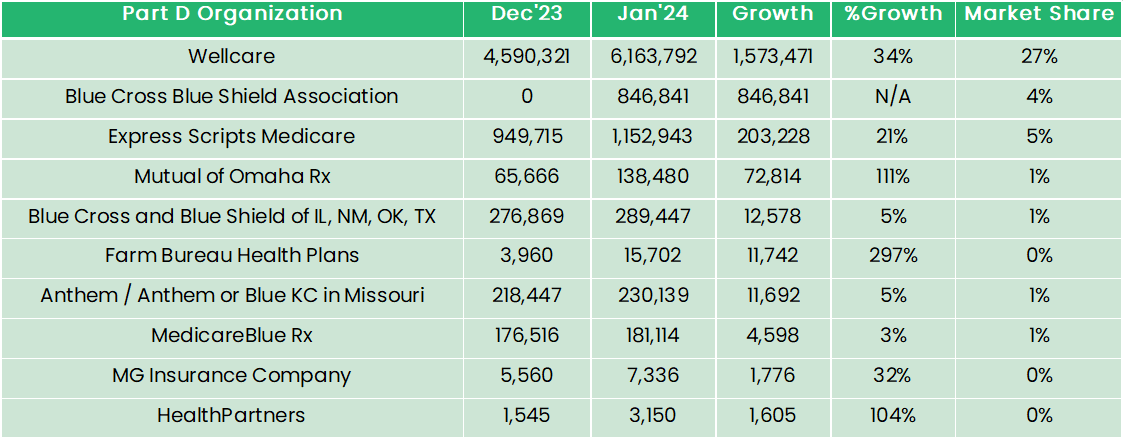

Wellcare controls 27% of the 2024 Part D market, and increased enrollment by 1,573,471 from December 2023 to January 2024.

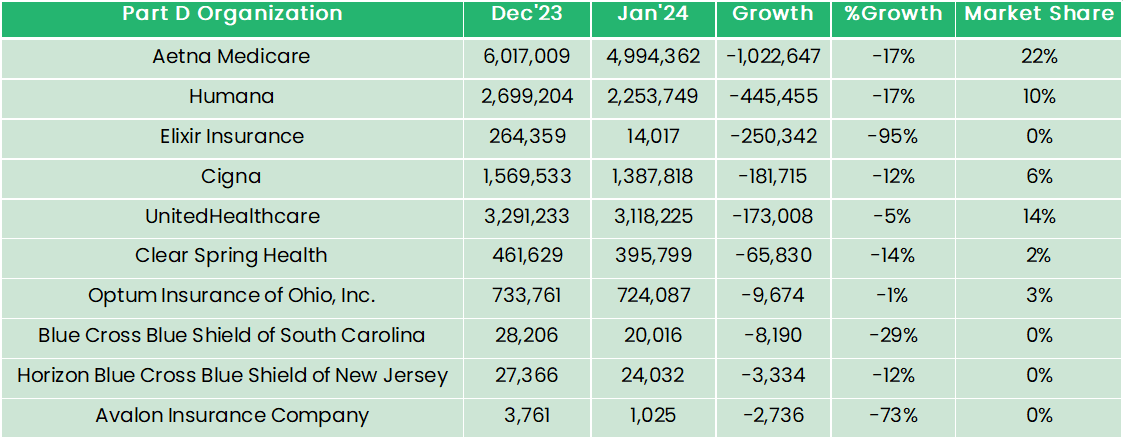

Aetna Medicare, United Healthcare, Humana, and Cigna also hold significant market share; however, each saw a large decline in enrollment from December 2023 to January 2024.

Notably, significant increases in enrollment were seen by Mutual of Omaha Rx (111%) and Farm Bureau Health Plans (297%), while Elixir Insurance decreased by 95%.

Blue Cross Blue Shield Association entered the employer-group Part D market, adding 846,841 enrollees.

Top 10 plans with Highest Growth from Dec ’23 to Jan ‘24

*Exclude plans with less than 10 enrollees.

Top 10 plans with Largest Decline from Dec ’23 to Jan ‘24

*Exclude plans with less than 10 enrollees.

Upcoming Program Changes

Beginning January 1, 2024, the Inflation Reduction Act of 2022 eliminated Medicare Part D beneficiary cost-sharing once out-of-pocket spending reaches $8,000 (Catastrophic Coverage Phase). Part D plans will pay 20% of total drug costs in the Catastrophic Coverage Phase, up from 15% in 2023.

In 2025, Part D plans will be responsible for 60% of total drug costs in the Catastrophic Coverage Phase, Medicare will be responsible for 20% (brand name) or 40% (generic), and drug manufacturers will cover the remainder.

Also beginning January 1, 2025, Medicare Part D beneficiaries out-of-pocket drug costs will be capped at $2,000 with annual adjustments thereafter. In addition, the Coverage Gap phase will be eliminated. Changes to the Initial Coverage Phase in 2025 include drug manufacturers providing a 10% discount on brand name drugs, with Part D plans paying the remaining 65% (75% for generic).

These changes are expected to result in higher Part D premium rates as more of the cost will be shifted to the carrier.

The act also requires the Secretary of Health and Human Services (HHS) to negotiate prices with drug manufacturers for certain drugs covered under Part D. There were 10 drugs selected for price negotiations to be implemented in 2026, 15 drugs in 2028, and 20 drugs from 2029 onward.

Sources: Medicare Prescription Drug Benefit Manual; Medicare.gov; CMS Part D Enrollment and Landscape files; H.R.5376 - Inflation Reduction Act of 2022

Sponsor Snapshot 🚀: Modivcare

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

Transportation,

In-Home & Personal Care,

Virtual & Remote Care Management,

Health Risk and SDOH Survey Capture

Learn more here → (click)

COMPLIANCE CHATTER 📢

While there has been much discussion and speculation regarding the proposed changes to Contract Year 2025 Medicare Advantage agent and broker compensation, we wanted to take a minute to discuss another regulatory change included in this CY2025 Proposed Rule.

The Bipartisan Budget Act of 2018 (Public Law No. 115-123) introduced Special Supplemental Benefits for the Chronically Ill (SSBCI), which are not primarily health related supplemental benefits offered by Medicare Advantage plans to eligible chronically ill enrollees. The intended purpose of SSBCI is to enable MA plans to better tailor benefit offerings, address gaps in care, and improve health outcomes.

CMS issued the following proposed regulatory changes for Contract Year 2025 that will ensure SSBCI offerings are appropriate and will improve or maintain the health or function of chronically ill enrollees.

Medicare Advantage plans must:

demonstrate through evidence, provided at time of bid submission, that SSBCI benefits have a reasonable expectation to improve or maintain health or function; and

utilize objective criteria in written policies for determining an enrollee’s eligibility for SSBCI benefits; and

document SSBCI eligibility denials instead of approvals; and

update disclaimer to list relevant chronic condition(s) the enrollee must have to be eligible and indicate even with the chronic condition, the enrollee is subject to other coverage criteria; and

include disclaimer in all marketing and communications mentioning SSBCI.

Additionally, CMS would be able to annually review SSBCI offerings for compliance and deny approval of a bid.

If you would like to learn more about our compliance services, reach out to [email protected].

DATA VISUAL of the Week 📊

This week’s data visual comes from kff.org highlighting the share if individuals getting Part D coverage on a stand-alone basis vs. with Medicare Advantage.

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: Promote your product or services to leaders in the Medicare space. Let’s discuss. (link)

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market, appraise your books of business, and keep you compliant. Let’s discuss. (link)