Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Q2 2025 Medicare Carrier Financials Side-By-Side 🏥

Sponsor Snapshot 🚀 - brought to you by Centerfield

Compliance Chatter 📢 - Check out the latest regulatory changes.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

What Medicare Consumers Really Want in AEP - (link)

Misleading Marketing Practices in Medicare Advantage - (link)

Fee-For-Service, Accountable Care Organizations, And Medicare Advantage: Why? - (link)

UnitedHealth Stock Is Cracking Despite Strong Earnings—Here’s What Wall Street Sees - (link)

Elevated Medicare Advantage, ACA marketplace costs sting insurers in mixed Q2 - (link)

HHS pilot program raises Democratic concerns over Medicare red tape - (link)

‘Game-changer’ bill would provide Medicare no-cost falls risk assessments - (link)

GoHealth Secures Financing to Bolster Medicare Market Position - (link)

Now Available: Updated Dental Market Projection Report - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Q2 2025 Medicare Carrier Financials Side-By-Side 🏥

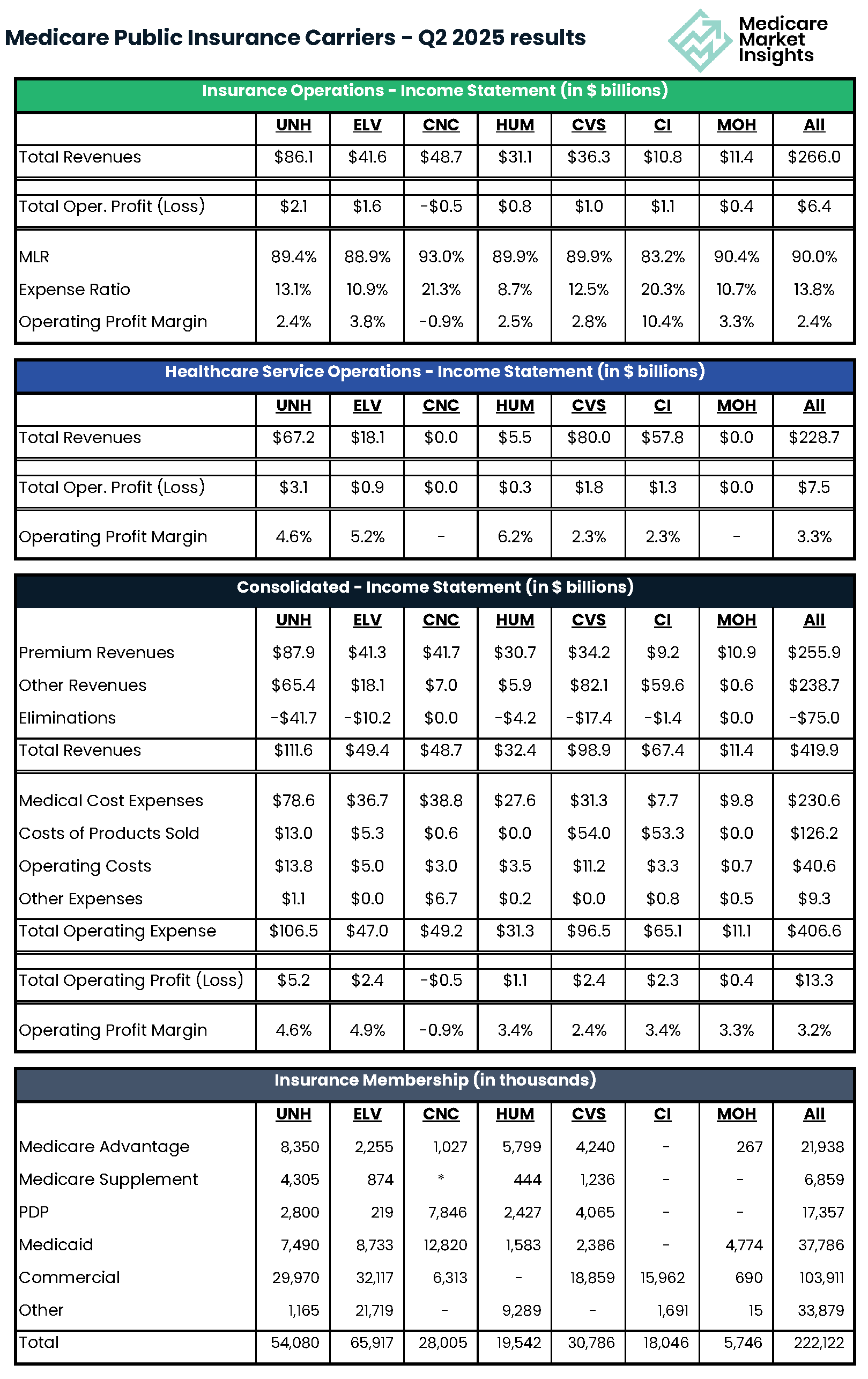

In this week’s deep dive, we are looking at publicly traded Medicare carrier Q2 2025 financials side-by-side.

Q2 2025 was a mixed bag for publicly traded Medicare carriers — revenues climbed, but profit margins fell across the board. High medical loss ratios are squeezing even the biggest players, and the stage is set for more plan cuts this AEP.

The insurance carriers included in this analysis are all trying to capture a piece of the growing Medicare market (along with other insurance markets), and do so profitably. Here they are:

UnitedHealth Group ( $UNH ( ▲ 3.65% ) )

Elevance Health ( $ELV ( ▲ 0.58% ) )

Centene Corp. ( $CNC ( ▲ 3.64% ) )

Humana ( $HUM ( ▲ 3.1% ) )

Molina ( $MOH ( ▲ 2.26% ) )

CVS ( $CVS ( ▲ 0.97% ) )

Cigna ( $CI ( ▲ 1.24% ) )

Aside from Centene and Molina, these carriers have both health insurance operations and healthcare services operations (providers, PBMs, pharmacies, etc.).

Note: Cigna sold their Medicare insurance business to HCSC. Therefore, we will likely drop Cigna from this analysis in the future.

Here is the split of Q2 2025 revenues between these two segments for each carrier:

Before comparing results I did want to mention a few newsworthy items from Q2:

—

Income Statement & Membership Side-By-Side

To compare and contrast the Q2 2025 results for each carrier, the Income Statement is split between “Insurance Operations” and “Healthcare Service Operations”. The consolidated statement is also displayed.

One Note: Healthcare Service Operations is different for each carrier, but generally includes providers, pharmacies, PBMs, and technology.

—

YoY % Change

Here is the % change in key metrics from Q2 2024 to Q2 2025.

—

Current Valuation Metrics

Despite revenue growth, valuation multiples remain under pressure - reflecting investor concern over sustained high MLRs, shrinking margins and regulatory pressure.

Here are current valuation metrics for these carriers:

—

Notable Observations

Membership

Cigna down 100.0% in membership for MA and Med Supp blocks due to the HCSC sale (more info here)

Humana down 100.0% in membership for Commercial block due to exiting the space last year (more info here)

Molina up 79% in Commercial membership

Humana up 31% in Med Supp membership

In total United, Elevance, and Molina are up in membership YoY and Centene, Humana, CVS, and Cigna are down in membership YoY.

Insurance Operations

Overall, Revenues up, Loss Ratio up, Profits down

United, Elevance and Centene saw the largest Loss Ratio increases

Humana and CVS saw much smaller increases to Loss Ratios

Healthcare Services Operations

Revenues up for everyone, Elevance with the largest % growth

Profit Margins down across the board

United and CVS with the biggest drop in profit margin

Consolidated Results

All Carriers saw increasing Revenue

and…. decreasing operating profit and profit margins

United and Centene with the largest drops in profit margin

—

Final Thoughts

Medicare Carriers continue to struggle with high Medical Loss Ratios and low Profits leading to suffering valuations.

As a result, I expect this coming AEP to include more plan terminations, service area reductions and benefit reductions.

The key to watch: whether carriers who scaled back last year — like Humana and CVS — seize market share while others retreat, or if the entire market remains defensive.

Stay tuned. Over the next few months we will learn a lot more, and will be keeping you up-to-date!

SPONSOR SNAPSHOT 🚀: Centerfield

What Medicare Consumers Really Want in AEP

It’s not just about cost anymore. Medicare shoppers now prioritize coverage, clarity, provider trust, and digital simplicity.

Centerfield Insurance analyzed 19,000+ enrollment calls and surveyed 1,000 shoppers to uncover:

✔️ Hidden friction points driving churn

✔️ Why simple, transparent messaging boosts retention

✔️ What keeps members loyal and what makes them leave Planning for AEP 2026?

These insights will help you engage smarter and retain better.

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this month’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: