This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - UnitedHealth Group - Q3 2024 Results

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - hits a milestone and recaps key legislation

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Cigna, Humana rekindle merger talks - (link)

MA cash cards could squeeze other senior benefits - (link)

Key Facts About Medigap Enrollment and Premiums for Medicare Beneficiaries - (link)

CVS Ousts CEO, Names Caremark Head as New Chief - (link)

Medicare Supplement - Highlights of 2023 U.S. Market Survey - (link)

Medicare Advantage under pressure: How MA-PD plans are responding in 2025 - (link)

Medicare Supplement Rate Actions – 2024 Q3 Update - (link)

Jared’s recent LinkedIn posts:

MA/MAPD members in Georgia are seeing a lot of disruption this AEP. - (link)

MA/MAPD October enrollment results… - (link)

Most of the MA/MAPD plan terminations this AEP are Local PPO plans. - (link)

Last week's Medicare Market Insights deep dive looked at the shift in Stars, Premiums, Drug Deductibles and MOOPs. - (link)

Important info for data nerds 🤓. We created a new data set for MMI+ - (link)

Elevance Health (ELV) reported Q3 2024 results today. - (link)

DEEP DIVE 📚

UnitedHealth Group - Q3 2024 Results

When it comes to companies focused on the Medicare market, UnitedHealth Group (NYSE: UNH) is the giant in the room.

But, they didn’t hit the scene overnight.

It’s been a long consistent growth over time, combined with vertical integration, that has resulted in their dominance.

A few weeks ago, UNH released Q3 ‘24 financials (see my LI post for some quick stats).

In this week’s deep dive, we are analyzing Quarter 3 results over the past 6 years to better understand recent trends. (We analyzed full year 2023 results here)

Before we get to the numbers it’s important to understand UNH’s two main business units, UnitedHealthcare and Optum.

UnitedHealthcare is an insurance carrier, providing health insurance benefits. They collect premiums, pay health insurance benefits, and make a profit on what’s left over.

Optum is (for the most part) a healthcare provider. This includes doctors, hospitals, value-based care clinics, technology and pharmacies. They receive revenues via health insurance benefits, pay expenses associated with running health provider systems, and make a profit on what’s left over.

This is what is called vertical integration!

Okay, now let’s look at some numbers.

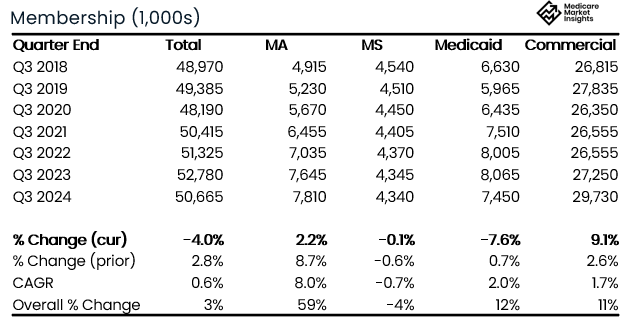

Membership

Surprisingly, overall membership growth has been very modest over the last 6 years.

Q3 ‘18 membership: 48.97 million

Q3 ‘24 membership: 50.67 million

Overall Growth: 3%

% Change (current yr.): -4.0%

% Change (prior yr.): 2.8%

CAGR (“Compound Annual Growth Rate”): 0.6%

The largest membership segment is their Commercial line. 2024 results show a significant uptick in growth after being mostly flat for several years. Likely due to growth in both Group business due to Humana exiting, and overall market growth in ACA business.

UNH is the market leader in the Medicare Supplement market, but the membership in that line of business has been in slight decline over the last several years.

The Medicaid line saw significant decline YoY. The decline is likely due to Medicaid “unwinding”.

The Medicare Advantage line has seen significant growth over the last 6 years. 2024 growth slowed significantly compared to 2023, and compared to the past 6 year CAGR (“compound annual growth rate”).

Revenues

UNH reports revenues by vertical (UnitedHealthcare and Optum), and provides further details within each vertical. In addition, “eliminations” are reported in order to remove revenues that Optum receives from UnitedHealthcare (can’t count that revenue twice).

UnitedHealthcare Q3 Revenues (the insurance Carrier segment) have grown steadily over the past 6 years.

Q3 ‘18 Revenues: $45.94 billion

Q3 ‘24 Revenues: $74.85 billion

Overall Growth: 63%

% Change (current yr.): 7.2%

% Change (prior yr.): 12.7%

CAGR: 8.5%

The largest segment is the Medicare & Retirement segment. The 9.0% YoY growth in Q3 2024 was down compared to the prior year and also below the CAGR.

All segments saw lower revenue growth in Q3 2024 compared to both the prior year and the CAGR.

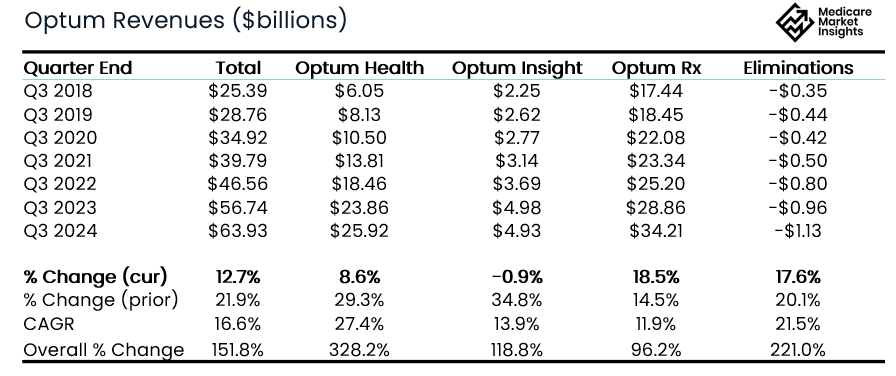

Optum Q3 Revenues (the healthcare provider segment) have grown 2.5x over the past 6 years.

Q3 ‘18 Revenues: $25.4 billion

Q3 ‘24 Revenues: $63.9 billion

Overall Growth: 152%

% Change (current yr.): 12.7%

% Change (prior yr.): 21.9%

CAGR: 16.6%

While Optum continued to grow significantly, all segments saw lower revenue growth in Q3 2024 compared to the prior year and all but Optum Rx were lower than the CAGR.

Combining UnitedHealthcare, Optum, and including eliminations, results in the company’s Total Consolidated Q3 Revenues.

Q3 ‘18 Revenues: $56.56 billion

Q3 ‘24 Revenues: $100.82 billion

Overall Growth: 78%

% Change (current yr.): 9.2%

% Change (prior yr.): 14.2%

CAGR: 10.1%

As you can see, revenue eliminations have grown steadily over the past 6 years, and have grown faster than overall top line revenue.

This indicates there is more vertical integration today than there was 6 years ago.

More of the insurance company benefit expense is going to Optum providers and pharmacies as revenue. (Since they already recognized the revenue in the insurance company, they can’t also recognize it as revenue in the provider company.)

Operating Income

The combined UnitedHealth Group’s Q3 Operating Income has grown steadily over the past 6 years.

Q3 ‘18 Operating Income: $4.59 billion

Q3 ‘24 Operating Income: $8.71 billion

Overall Growth: 90%

% Change (current yr.): 2.1%

% Change (prior yr.): 14.3%

CAGR: 11.3%

Q3 Operating Income growth of 2.1% YoY was far lower then the prior year growth (14.3%) and lower than the CAGR (11.3%).

Lower overall income driven by the decline in UHC and Optum insights profits.

Optum Health and Optum Rx both saw significant growth YoY.

Medical Loss Ratio

The Medical Loss Ratio has been a major topic point in the Medicare industry over the past year with most companies reporting higher utilization in Medicare products resulting in higher loss ratios.

[Note: elevated Medicaid loss ratios are also contributing]

You can see in the chart below that the Q3 2024 loss ratio of 85.2% is the highest reported over the prior 7 years.

It’s the key thing driving the decreased operating income for the insurance business.

Bottom Line

Medicare Advantage membership growth slowed in 2024 while Commercial saw a significant increase.

Overall Revenue growth slowed during Q3 2024 for all segments.

Overall profitability growth slowed in Q3 2024 compared to Q2 2023.

The 8.6% profit margin continues to be healthy.

The company highlighted their steadiness in the Medicare Advantage when discussing this AEP.

The loss ratio continues to be elevated compared to recent history and continues to be something to watch.

With higher than normal plan terminations, benefit reductions, and increased deductibles and MOOPs this AEP, it will be interesting to see how UHC fairs. I expect them to grow at or above the overall market rate.

Sources: Company Quarterly Earnings Releases

What MMI + Subscribers read this week…

MA Plan Termination 2025 - A deep dive into the 2025 MA Plan Terminations by Plan Type, Carrier & State. [includes downloadable data set!] (link)

New MA/MAPD Enrollment, Crosswalk, Landscape Dataset 📊 - New Downloadable data set allows you to compare Star Ratings, Premiums, Drug Deductibles and MOOPs (link)

October MA/MAPD and PDP enrollment data - October enrollment data has been loaded. Here are a few observations. (link)

Sponsor Snapshot 🚀: Modivcare

Managing the complexity of chronic care conditions is compounded by social determinants of health, which is why Modivcare focuses on removing barriers to critical health services and connecting members to their care teams.

By addressing factors such as transportation and remote monitoring support, we bridge the gap between members, their health plan, and their care team to improve condition management and quality of life.

Learn how Modivcare can fit into your members’ coordinated care ecosystem with solutions such as:

Non-emergency medical transportation

Virtual & remote patient care

In-home & personal care solutions

Integrated supportive care solutions

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter, which celebrates reaching over 800 subscribers by recapping the key legislation that has passed since the newsletter started in April 2024.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: