Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - UnitedHealth Group Q2: Growth Under Pressure

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - Check out the latest regulatory changes.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Bipartisan Bill Seeks to Establish Parity Between MA & Traditional Medicare Payments - (link)

UnitedHealth says 2025 earnings will be worse than expected as high medical costs dog insurers - (link)

UnitedHealthcare to exit certain Medicare Advantage markets as costs balloon, impacting 600K enrollees - (link)

Medigap Regulations Provide Protections For Beneficiaries, Especially After Health Shocks, But May Raise Premiums - (link)

More than half of patient harm events missed by hospital surveillance systems: HHS OIG - (link)

Trump administration is launching a new private health tracking system with Big Tech’s help - (link)

Trump is demanding drugmakers lower prices within 60 days. Pharma experts say it’s unlikely to happen. - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

UnitedHealth Group Q2: Growth Under Pressure

UnitedHealth Group ( $UNH ( ▲ 0.02% ) ), the nation’s largest Medicare focused insurer, is facing one of its most challenging years in a decade.

With profitability squeezed, leadership changing (CEO, CFO), DOJ investigations (link) underway, and plans to cut 600,000 members (link), Q2 results reveal the pressure points - and what might come next.

Let’s dive in.

__

Membership Trends

Membership growth has been lead by Medicare Advantage enrollment growth.

Membership in Medicare Supplement declined, continuing a longer term trend.

Medicaid changed course with a small increase, while Commercial growth slowed compared to the prior year.

One additional note on Medicare Advantage growth. United’s growth was primarily driven by C-SNP enrollment. C-SNP growth started this past AEP and has continued throughout 2025.

source: MA Enrollment Insights web app

—

Revenue Trends

UNH reports revenues by vertical (UnitedHealthcare and Optum), and provides further details within each vertical. In addition, “eliminations” are reported in order to remove revenues that Optum receives from UnitedHealthcare (can’t count that revenue twice).

UnitedHealthcare Q2 Revenues (the insurance Carrier segment) have grown steadily over the past 7 years.

Year-over-year quarter 2 revenue grew significantly more (16.6%) than is typical (9.4% CAGR), driven by 20%+ growth in both Medicare & Retirement and Community & State.

—

Optum Q2 Revenues (the healthcare provider segment) have grown 2.7x over the past 7 years.

Overall, Optum Revenues lagged historical growth.

Optum Health Revenues decreased year-over-year while Optum RX outpaced historical growth.

—

Combining UnitedHealthcare, Optum, and including eliminations, results in the company’s Total Consolidated Q2 Revenues.

Overall Revenue growth (12.9%) outpaced historical growth rates (10.3% CAGR).

Driven by strong growth in the insurance business.

—

Operating Income Trends

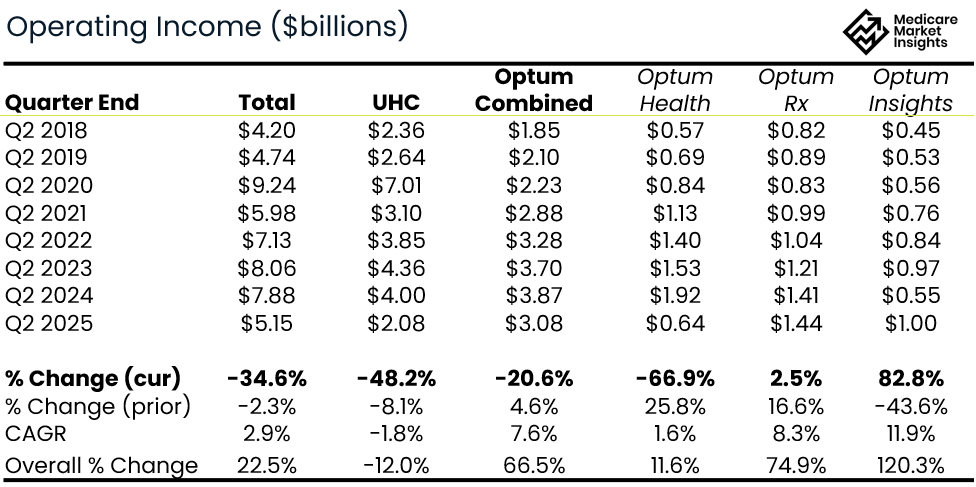

The combined UnitedHealth Group’s Q2 Operating Income has grown steadily over the past 7 years until this year!

Operating Income is down substantially with the largest drop coming from UHC (insurance business) and Optum Health (provider business).

Optum Insights grew year-over-year, but makes up a small percentage.

—

Medical Loss Ratio Trends

The Medical Loss Ratio has been a major topic point in the Medicare industry over the past year with most companies reporting higher utilization in Medicare products resulting in higher loss ratios.

[Note: elevated loss ratios in other product lines are also contributing]

You can see in the chart below that the Q2 2025 loss ratio of 89.4% is the highest it’s been in recent history.

—

Profit Margins

The loss ratio chart above, along with the profit margin chart below goes along way in telling the story of why all the recent changes with $UNH ( ▲ 0.02% ) .

The 4.6% profit margin is far below the typical 7-9%.

__

Bottom Line

UnitedHealth’s Q2 paints a picture of growth under strain. Membership and revenue are climbing, but elevated utilization is driving the highest loss ratios in years and cutting profit margins nearly in half.

These financial pressures are already reshaping their strategy - from large-scale plan terminations to a sharper focus on C-SNP growth. Expect a tighter product portfolio and more disciplined benefit design heading into AEP 2026.

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access their care through remote monitoring and virtual care management. We’re there to help members live more confidently by enabling them to access the care they need to live independently. Our results speak for Modivcare Monitoring’s ability to address cost and close gaps in care across our services.

Learn now Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Acuity-based vitals monitoring - from digitally-enabled to clinician-led

Medication Management

E3 - Engage, Educate, Empower to address health literacy and support gap closure

Modivcare - Bring Care Everyday to your members → (Link)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this month’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: