This week’s newsletter is Sponsored By: Modivcare

Modivcare Monitoring drives higher member retention → (Link)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - 2026 MA, MAPD, Part D Landscape 🏞 - Part 1

Sponsor Snapshot 🚀 - brought to you by Modivcare

It’s only a 6 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

People with Medicare Will Face Higher Costs for Some Orphan Drugs Due to Changes in the New Tax and Budget Law - (link)

Understanding the Difference Between Anniversary Rating and Next Renewal Rating in Medicare Supplement Policies - (link)

Medicare Could Tie Commission Growth to Overall Inflation Rate - (link)

30 health systems dropping Medicare Advantage plans | 2025 - (link)

Georgetown University CHIR Medicare Reform White Paper - (link)

Kettering Health ending two Medicare Advantage contracts - (link)

Hospitals peg Medicare payment fight on SCOTUS ruling - (link)

2026 Medicare Advantage and PDP Landscape - (link)

Challenges of Choice in Medicare - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

2026 MA, MAPD, Part D Landscape 🏞 - Part 1

Last week, CMS released the Landscape file for the upcoming 2026 plan year for Medicare Advantage and Part D. They are expected to release the Crosswalk file any day now.

These publicly available files that are released every Fall hold a wealth of information, and you might feel like you need a crossing guard to help you cross over into the 2026 plan year. Don’t worry, we’ve got you covered.

The Crosswalk file will give us all Contract and Plan combinations from the 2025 plan year and tell us if these plans are renewing, renewing with service area consolidation, expansions, or reductions, or terminating. It also introduces new plans for 2026.

The Landscape file contains information on all Medicare Advantage and Part D plans for 2026 including Contract, Plan, and Segment ID’s, State and County, Organization and Marketing names, plan type, SNP type, Part C and Part D premiums, and drug benefit information.

When combined, these Crosswalk and Landscape files tell us what the Medicare Advantage and Part D market will look like in the upcoming plan year compared to the previous year.

Today we will specifically be looking at the difference in distinct number of Contract and Plan combinations between the 2026, 2025, and 2024 files by:

Plan Type (HMO, PPO, SNP, etc.) – Here’s a quick refresh on types of plans

Parent Organization

State

—

Overall Look

First let’s look at the number of available plans for Non - Special Needs Plans (“Non SNPs”):

We can see that:

The number of available HMO plans will decrease 7% 🔻 (-135) from 2025 to 2026, also decreasing 14% 🔻 (-302) from 2024

The number of available PPO plans will decrease 12% 🔻 (-190) from 2025 to 2026, also decreasing 16% 🔻 (-275) from 2024

The number of available Part D plans will decrease 31% 🔻 (-167) from 2025 to 2026, also decreasing 47% 🔻 (-319) from 2024

MMP plans are sunsetting December 31, 2025 [Check out this deep dive to see how many enrollees are impacted]

For Special Needs Plans (“SNPs”), the trend is different:

We can see that:

The number of available D-SNP plans will increase 12% 🚀 (113) from 2025 to 2026, also increasing 21% 🚀 (177) from 2024

The number of available C-SNP plans will increase 46% 🚀 (172) from 2025 to 2026, also increasing 76% 🚀 (237) from 2024

The number of available I-SNP plans will decrease 4% 🔻 (-6) from 2025 to 2026, also decreasing 11% 🔻 (-19) from 2024

This points to the continued expansion of Special Needs plans in the market.

—

By Parent Organization

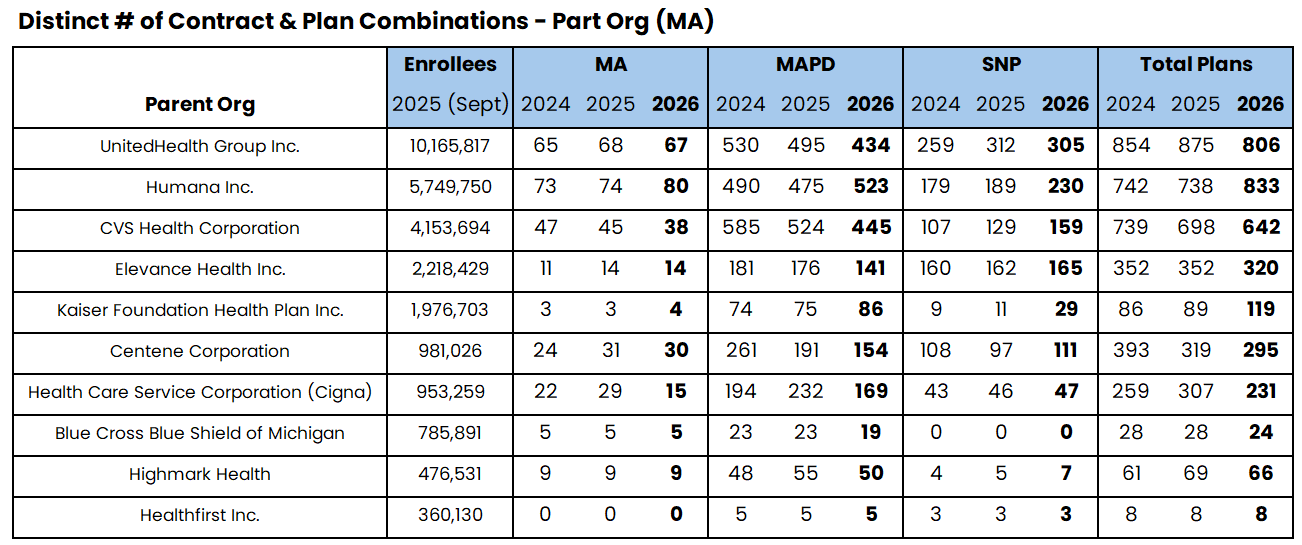

When looking at the TOP 10 Medicare Advantage Parent Organizations with the most enrollees as of September 2025, we can see that:

The number of available MA plans (without Part D benefits) will decrease 6% 🔻 (-16) in 2026

The number of available MAPD plans (MA with Part D benefits) will decrease 10% 🔻 (-225) in 2026

The number of available SNP plans will increase 11% 🚀 (102) in 2026

Out of the 102 new SNP plans in 2026, Humana is adding 41 and CVS Health is adding 30

Enrollee Count Source: Medicare Advantage Enrollment Insights web app available to MMI+ subscribers

When looking at the TOP 6 Part D Parent Organizations with the most enrollees as of September 2025, we can see that:

The number of available Part D plans will decrease 31% 🔻 (-167) in 2026

Centene and Health Care Service Corporation (Cigna) account for the majority of Part D plan decreases

Elevance Health withdrew all Part D plans from the market in 2026

Enrollee Count Source: Medicare Advantage Enrollment Insights web app available to MMI+ subscribers

—

By State

The overall number Medicare Advantage plans (including MA, MAPD, and SNP) will decrease 2% 🔻 (-119) nationally from 2025 to 2026. The map below breaks down the change by state.

We can see that:

Texas, Missouri, and Florida will see the largest increase in the number of available Medicare Advantage plans in 2026

Minnesota, New York, Colorado, and Indiana will see the largest decrease in the number of available Medicare Advantage plans in 2026

In comparison, almost all states are seeing a decrease of 4 to 7 Part D plans in 2026.

That’s all for now. Keep following us, as we will continue to dive into the Crosswalk and Landscape files over the coming weeks, providing more insight as we “cross” into AEP2026.

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access their care through remote monitoring and virtual care management. We’re there to help members live more confidently by enabling them to access the care they need to live independently. Our results speak for Modivcare Monitoring’s ability to address cost and close gaps in care across our services.

Learn now Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Acuity-based vitals monitoring - from digitally-enabled to clinician-led

Medication Management

E3 - Engage, Educate, Empower to address health literacy and support gap closure

Saving lives, preserving independence → (Link)

What MMI + Subscribers read this week…

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: