This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - MA, MAPD, PDP Landscape 🏞 - Part 1

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - final guidance from CMS, DE, MN and more…

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

With Medicare’s annual enrollment period 2 weeks away, here’s what major payers will have on offer - (link)

Kamala Harris Will Propose New Medicare Benefit To Cover Home Care Costs For Seniors - (link)

Medicare Plans’ Administrative Expenses Accelerated in 2023 - (link)

Premara Blue Cross Exciting Medicare Coverage Solutions - (link)

Spending by the Veterans Health Administration for Medicare Advantage Dual Enrollees, 2011-2020 - (link)

UnitedHealth Sues US Over Quality Rating Drop Tied to Phone Call - (link)

WTW to sell TRANZACT - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

MA, MAPD, PDP Landscape 🏞 - Part 1

CMS has released the Crosswalk and Landscape files for the upcoming 2025 plan year for Medicare Advantage and Part D.

These publicly available files that are released every October hold a wealth of information, and you might feel like you need a crossing guard to help you cross over into the 2025 plan year. Don’t worry, we’ve got you covered.

The Crosswalk file gives us all Contract and Plan combinations from the 2024 plan year and tells us if these plans are renewing, renewing with service area consolidation, expansions, or reductions, or terminating. It also introduces new plans for 2025.

The Landscape file contains information on all Medicare Advantage and Part D plans for 2025 including Contract, Plan, Segment ID, State and County, Organization and Marketing name, plan type, SNP type, Part C and Part D premiums, and drug benefit information.

When combined, these Crosswalk and Landscape files tell us what the Medicare Advantage and Part D market will look like in the upcoming plan year compared to the previous year.

Today we will specifically be looking at the difference in distinct number of Contract and Plan combinations between the 2024 and 2025 files by:

Plan Type (HMO, PPO, SNP, etc.) – Here’s a quick refresh on types of plans

Parent Organization

State

Overall Look

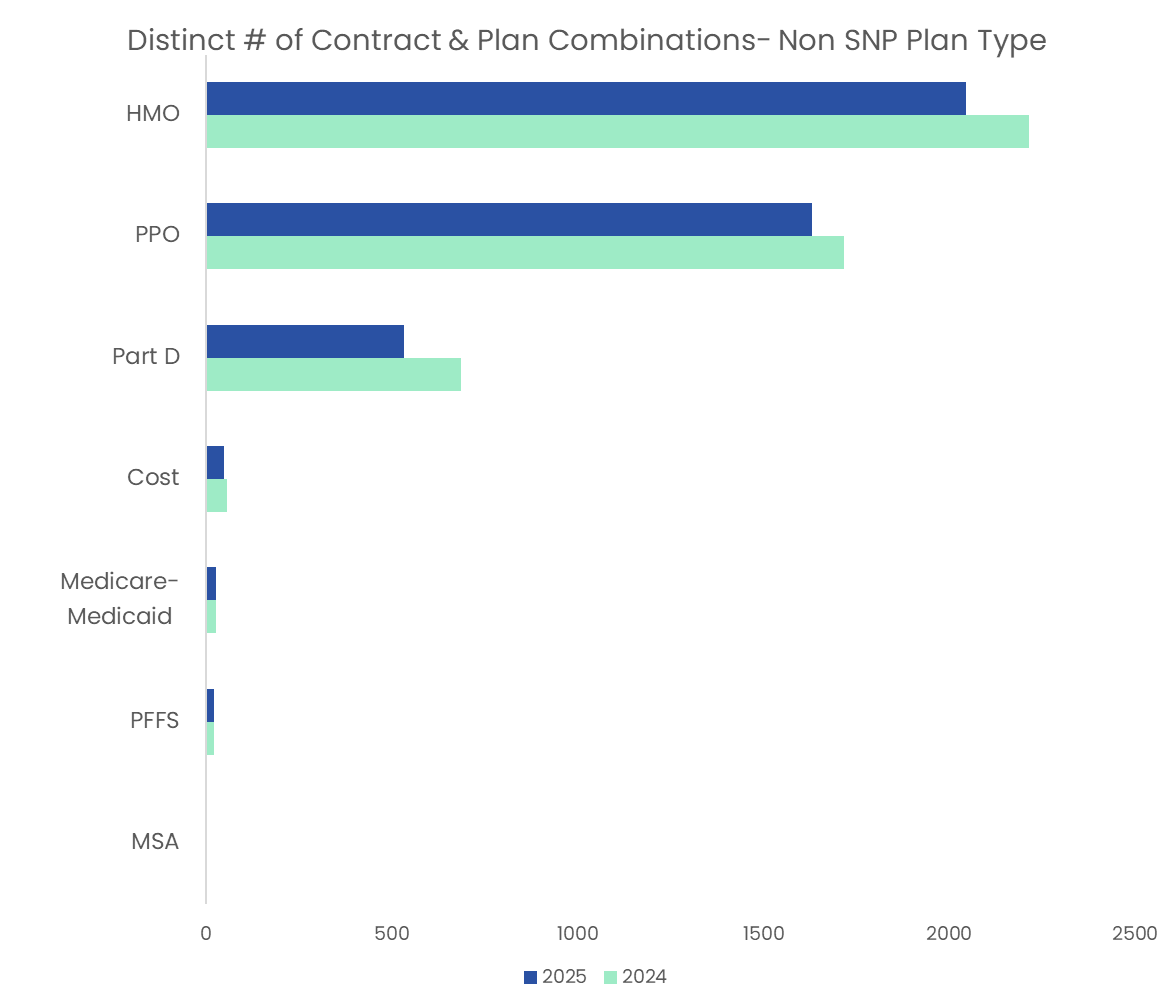

First let’s look at the number of available plans for Non - Special Needs Plans (“Non SNPs”):

We can see that:

The number of available HMO plans will decrease 8% 🔻 (167) from 2024 to 2025

The number of available PPO plans will decrease 5% 🔻 (85) from 2024 to 2025

The number of available Part D plans will decrease 22% 🔻 (-152) from 2024 to 2025

For Special Needs Plans (“SNPs”), the trend is different:

We can see that:

The number of available D-SNP plans will increase 8% 🚀 (64) from 2024 to 2025

The number of available C-SNP plans will increase 21% 🚀 (65) from 2024 to 2025

The number of available I-SNP plans will decrease 8% 🔻 (-13) from 2024 to 2025

This points to the continued expansion of Special Needs plans in the market.

[Check out this deep dive for a look at historical growth and a look at what’s changing in the D-SNP and C-SNP markets in 2025]

By Parent Organization

When looking at the TOP 10 Medicare Advantage Parent Organizations with the most enrollees as of September 2024, we can see that:

The number of available MA plans (without Part D benefits) will increase 5% 🚀 (14) in 2025

The number of available MAPD plans (MA with Part D benefits) will decrease 9% (210) in 2025

The number of available SNP plans will increase 8% 🚀 (70) in 2025

Out of the 70 new SNP plans in 2025, UnitedHealth Group is adding 53

Enrollee Count Source: Medicare Advantage Enrollment Insights web app available to MMI+ subscribers

When looking at the TOP 8 Part D Parent Organizations with the most enrollees as of September 2024, we can see that:

CVS and UnitedHealth Group account for the majority of Part D plan decreases

The number of available Part D plans for the other identified carriers remains the same for 2025

Group 1001 increased 27 Part D plans from 2024 to 2025, however, all plans are sanctioned in 2025

Enrollee Count Source: Medicare Advantage Enrollment Insights web app available to MMI+ subscribers

By State

The overall number Medicare Advantage plans (including MA, MAPD, and SNP) will decrease by 3% (138) nationally from 2024 to 2025. The below map breaks down the change by state.

We can see that:

Mississippi, Pennsylvania, Louisiana and North Carolina will see the largest increase in the number of available Medicare Advantage plans in 2025

California, Wisconsin, New York and Florida will seen the largest decrease in the number of available Medicare Advantage plans in 2025

In comparison, the number of available Part D plans decreased by 152 from 2024 to 2025, with almost all states seeing a decrease of 4 to 7 plans in 2025.

That’s all for now. Keep following us, as we will continue to dive into the Crosswalk and Landscape files over the coming weeks, providing more insight as we “cross” into AEP2025.

What MMI + Subscribers read this week…

MA Plan Termination 2025 - A deep dive into the 2025 MA Plan Terminations by Plan Type, Carrier & State. [includes downloadable data set!] (link)

Sponsor Snapshot 🚀: Modivcare

Managing the complexity of chronic care conditions is compounded by social determinants of health, which is why Modivcare focuses on removing barriers to critical health services and connecting members to their care teams.

By addressing factors such as transportation and remote monitoring support, we bridge the gap between members, their health plan, and their care team to improve condition management and quality of life.

Learn how Modivcare can fit into your members’ coordinated care ecosystem with solutions such as:

Non-emergency medical transportation

Virtual & remote patient care

In-home & personal care solutions

Integrated supportive care solutions

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter, which includes final guidance from CMS, a state bulletin from Delaware, an effective date revision to Minnesota’s 2023 Omnibus Bill Medicare changes, and a look at the formal letter sent to OCR by NAIC regarding Section 1557 of the ACA (non-discrimination).

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: