This week’s newsletter is Sponsored By: Medicare Market Insights +

Now includes access to Insurance Regulatory Insights → (Learn More)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Medigap Market Update - Q4 2025

Sponsor Snapshot 🚀 - brought to you by Medicare Market Insights +

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

The Next Chapter of Medicare Advantage and Part D: Key Takeaways from the 2027 Proposed Rule - (link)

Louisiana abruptly cuts two Medicaid contracts, putting care options for 488,500 in limbo - (link)

CMS confirms Medicare revalidation suspension, acknowledges lost applications - (link)

What to expect from the 2026 Medicare Physician Fee Schedule - (link)

AARP raises a red flag on Social Security, Medicare - (link)

Medicare Supplement Year-End Checklist - (link)

Goliath v. Goliath - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Medigap Market Update - Q4 2025

The Medicare Supplement market has over 14 million members. While the Medicare Advantage market goes through another season of turbulence, the Medicare Supplement market has been experiencing it’s own hurdles.

In this week’s deep dive we take a look at New Products, Rate Increases, Claims Trend and Regulatory updates in the Medigap Market.

—

New Products

→ No companies initiated new multi-state product filings during Q4.

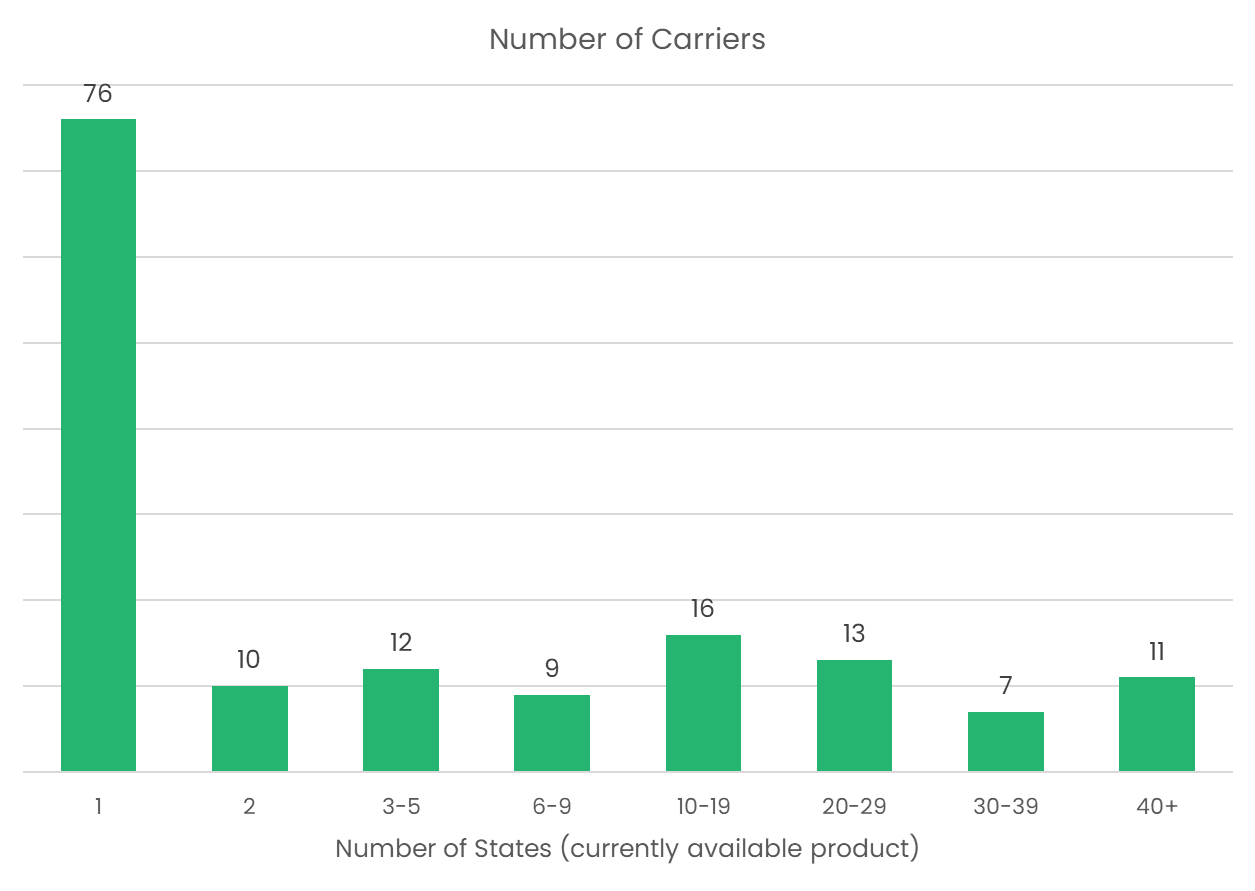

→ The following chart shows the breakdown of carriers by number of states where they are offering plans today.

There are approximately 150 carriers that are offering Medicare Supplement plans today and about half of them are operating in just one state.

—

Rate Increases

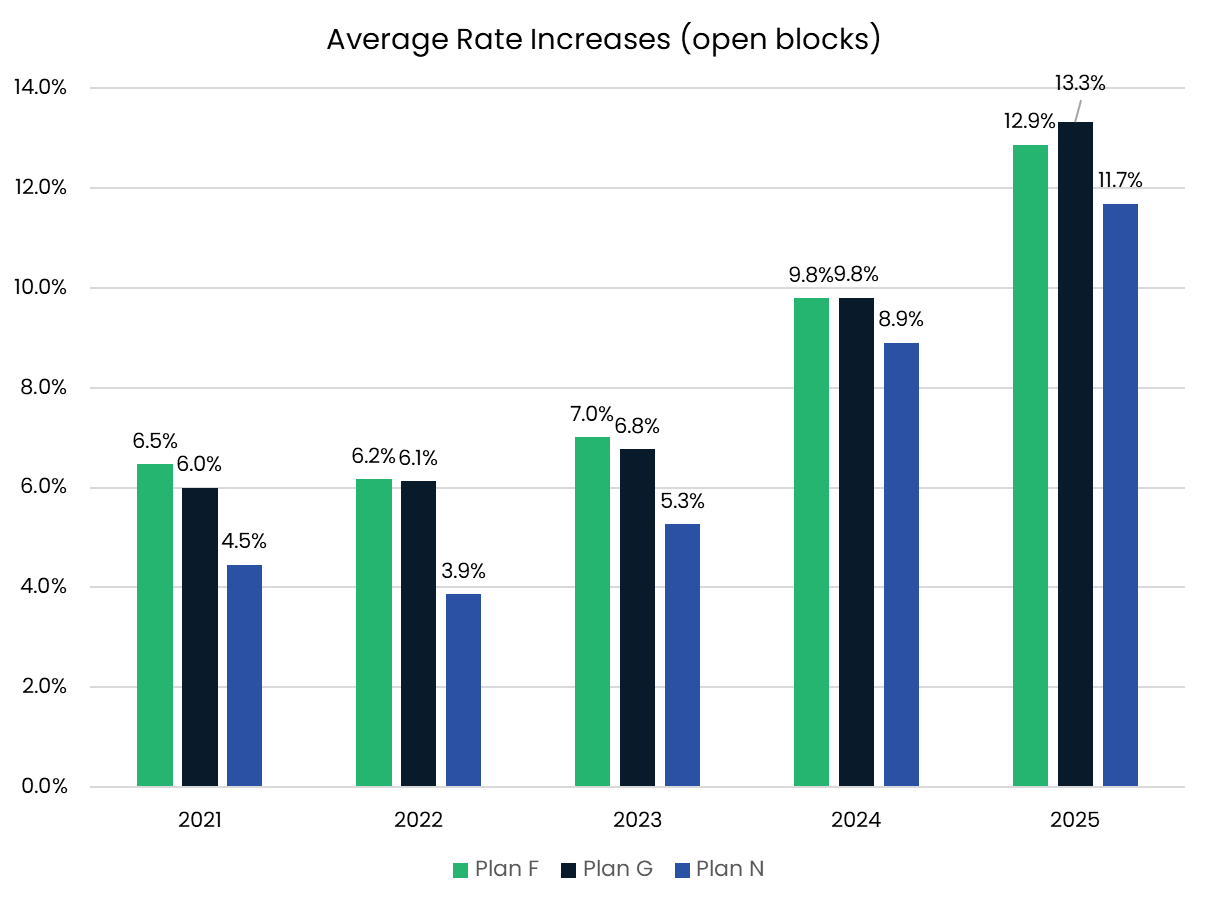

→ 2025 rate filings continue to show approved increases that are 2.5% - 3.5% higher than those approved in 2024.

→ The following chart shows the average rate increases on open Medigap blocks for Plans F, G, and N over the past four years.

→ The frequency of double digit rate changes has stabilized but they continue to be much more common than in previous years.

→ The following table shows the frequency of Plan G rate increases by different levels of increase. About 40% of open blocks are implementing rate increases that are less than 10%.

Increase Amount | 2022 | 2023 | 2024 | 2025 |

20%+ | 1% | 1% | 1% | 12% |

15 – 19.9% | 4% | 5% | 11% | 19% |

10 - 14.9% | 15% | 12% | 23% | 30% |

5 - 9.9% | 45% | 48% | 55% | 31% |

<5% | 36% | 35% | 11% | 8% |

—

Updated Medigap Claim Trend Estimates

→ Experience through August suggests that Medigap claim cost trends may be down 1% from previous years.

→ Plan F and Plan G medical trends have been ranging from 10-11% over the past 3 years.

→ 2025 is showing medical trends between 9-10%.

→ We expect that these higher trends will continue to keep Loss Ratios elevated. There will be relief towards that latter half of 2026 as rate increases become more fully realized on and the higher premiums have a chance to impact experience.

—

Regulatory Updates

→ No material new Medigap regulations have been passed during Q4

→ Don’t forget that DE and IN have new Birthday Rule Guarantee Issue requirements that are effective 1/1/2026.

→ And that VT has a new rule effective on 1/1/2026 that will impact the timing of rate increase filings so that their new public comment period can be accommodated.

For more detailed information on Regulatory changes, you can subscribe to our Insurance Regulatory Insights newsletter.

That is all for this deep dive into the Medicare Supplement market.

SPONSOR SNAPSHOT 🚀: Medicare Market Insights Plus

What is Medicare Market Insights - Plus?

Medicare Advantage Insights Web Application tool

Members-Only Content

Insurance Regulatory Insights + Reg Tracker

All the moving pieces in the Medicare market result in opportunities!

Opportunities for you to help more consumers.

Opportunities for distributors to grow books of business.

Opportunities for Carriers to add new members.

Opportunities for Investors to invest in companies solving problems in the changing Medicare space.

What are you going to do to take advantage?

Stop guessing. Start making informed decisions.

What MMI + Subscribers read this week…

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: